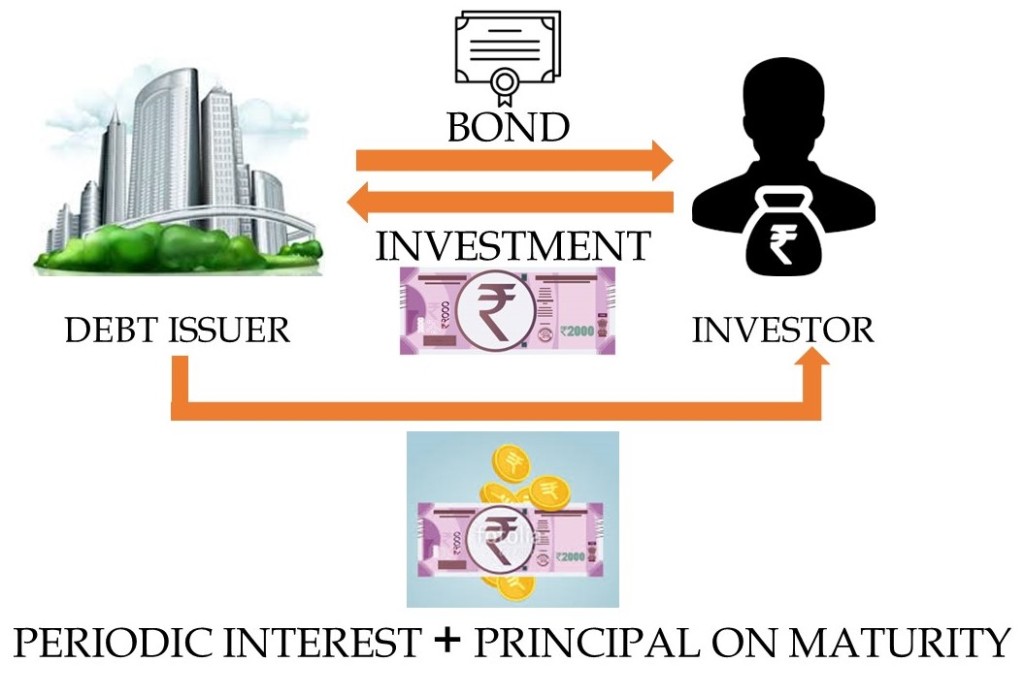

WHAT ARE DEBT SECURITIES?

A debt security represents money borrowed by the issuer of the security that must be repaid with interest at its maturity. It is a type of financial asset that is created when one party lends money to another. For example, corporate bonds are debt securities issued by corporations and sold to investors. Investors of corporate bonds lend money to corporations in return for a pre-established number of interest payments along with the return of their principal upon the bond’s maturity date.

The structure of a bank deposit or fixed deposit is very similar to debt security. However, debt instruments usually provide higher returns as compared to fixed deposits.

RETURNS ON DEBT SECURITIES

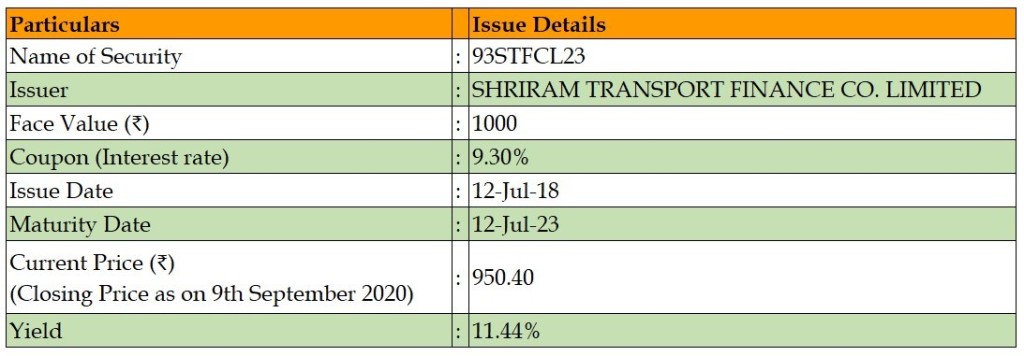

Return on investment in debt securities is derived in the form of the yield of the security. Yield is the earning generated and realized on the investment over a particular period of time. Yield is a function of the current market value, maturity value (usually the face value), coupon (interest rate) and time to maturity.

The NDS – RST platform by the Bombay Stock Exchange offers information based on which yield of a bond can be calculated. The required information can be obtained from other sources as well.

ADVANTAGES OF INVESTMENT IN DEBT SECURITIES

- Low Risk

Investment in debt instruments is less risky as compared to equity instruments. The value of debt security fluctuates less in the market. Further; in case of bankruptcy, debt investors are paid before making payments to equity shareholders.

- Predictable Returns

Debt instruments pay interest at pre-determined fixed interest rates and time periods. Also, the maturity value of the security is pre-decided. Hence, returns can be predicted to a high degree of certainty.

- Various types

The financial market offers a plethora of debt instruments including securities based on the type of issuer such as central government, state governments, public and private corporations, etc. There are also several types of securities based on maturity periods (treasury bills), treatment at maturity (convertible, non-convertible) and interest payout (coupon-bearing bonds, zero-coupon bonds).

- Diversification

Diversification is the practice of spreading your investments such that your exposure to any one type of asset is limited. Debt investments may act as a cushion against the unpredictable ups and downs of the equity market, as they often behave differently than stocks.

DISADVANTAGES OF INVESTMENT IN DEBT SECURITIES

- Comparatively Lower Returns

Debt investments are comparatively safer than equity. However, this safety comes at a price that is lower returns than equity investments. Debt securities usually yield lower returns as compared to equity. Debt security depends primarily on its coupon rate for investor returns.

- Credit Risk

Credit risk is the risk of default on a debt that may arise from a borrower failing to make obligated payments. If the cash flows of the issuer are negatively impacted, the investor may not receive the interest payments and even the principal at times. The factor of credit risk increases the importance of credit ratings for the issuer as well as the instrument. In the case of Government securities, credit risk is usually low as the chances of a government defaulting on its debt repayments are low.

- Liquidity

Liquidity is the ease of sale or exchange of an asset. Debt instruments can are traded through the stock exchanges or facilities made available by the regulator such as the RBI. However, not all securities are listed or traded in the open market. These securities are traded in the over-the-counter (OTC) market and tend to be comparatively less liquid.

WHY SHOULD ONE INVEST IN DEBT SECURITIES?

Debt securities have three notable characteristics: safety, surety and stability – the 3 S’s of debt. There is a guarantee of income and return of principal wherein the level of the guarantee depends on the credit risk associated with the issuer and the instrument. Debt securities give a cushion to your portfolio against extremely volatile conditions. However, the benefits of debt securities in the form of 3 S’s come at a price that is moderate returns. Hence, debt securities should ideally be clubbed with equity and other securities to form a balanced and well-diversified portfolio.

Sources: Parts of this article have been taken from or have been inspired by related content uploaded on the website of Moneycontrol, Investopedia and Economic Times.

Disclaimer: This content; including images and other visualizations, may include information from sources believed to be providing accurate information. Content and materials provided are for general information only. Views and opinions expressed in the article are personal opinions of the author and should not be considered as solicitation for investment in any security.